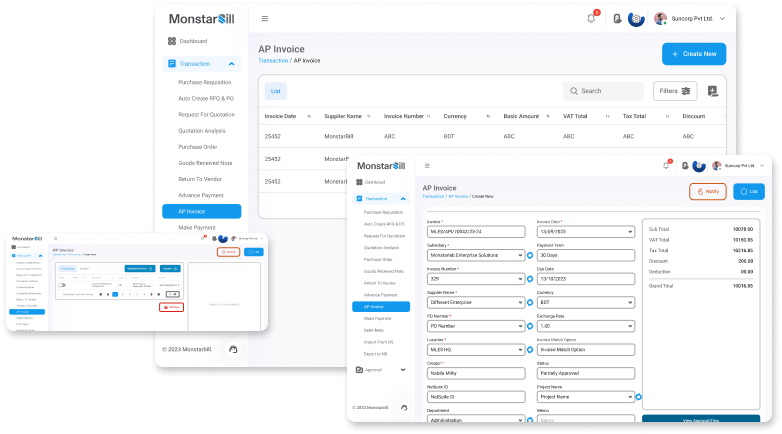

Verify Expenses with Invoices & Receipts

Reduce human error in data entry which impacts strategic decision making and prevent the scope of fraudulent activities.

Reconcile Bank Statement with Expense Report

Take proactive measures against potential scope of discrepancies through systematic and regular bank reconciliation.

More Accurate Forecasting

MonstarBill’s expense reconciliation features help comparing actual expenses incurred to budgeted overheads, which allows more reliable forecasting.

Get Reconciliation Reports

Bring visibility and enhance communication flow within your workflow. Regular reconciliation reports help your operation to stay organized, accountable and resolve issues as they arise.

Detailed History of User Activity

Spot on users making any duplicate or inaccurate entries with detailed history of activity for every event occurring within MonstarBill. Building higher responsibility and obligations within your organization.